Mining – A Steady Resurgence

2019 has seen some positive progression in the mining sector. Driving production through volatile commodity price periods has been a clear focus in both metals and coalmining houses, resulting in significant increased demand for mining operations and production professionals. Such resurgent industries always drive challenging efforts in attraction and retention, particularly with changing demands on salaries, benefits and flexibility. As the year has evolved, this positive momentum has brought on some challenges and here’s some themes we’ve witnessed across the sector…

Mining Overview

For mining houses, capitalising on improved commodity indexes has been a central theme of the past 18-24 months. The instability of the preceding 3-5 years in the sector forced miners to cut capital, enhance org charts, review and negotiate contracts, extend payment terms and heavily optimise OPEX to align with market conditions. In 2018, it became clear the tide was turning and we’re now starting to see the benefits and challenges of the resurgent industry cycle. Central to the challenges here is people – attraction, retention, keeping up with moving remuneration and benefits’ structures, and dealing with a new emerging skills shortage.

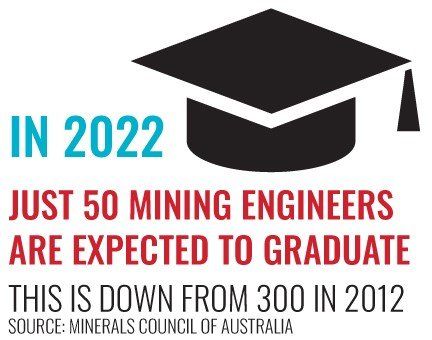

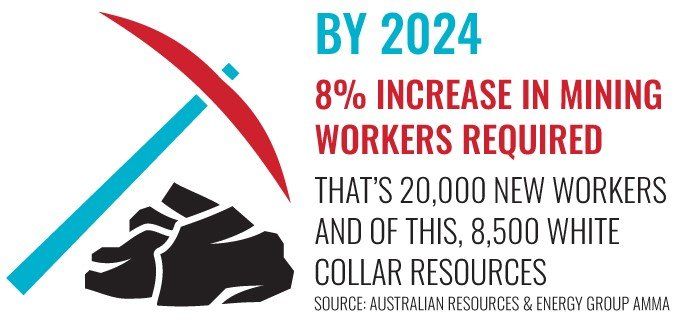

A September 2019 report released by Australian Resources & Energy Group AMMA highlighted an 8% increase in mining workers required by 2024. That’s 20,000newworkers and of this, 8,500 white collar resources ranging from engineers, supervisors, managers, geologists and other related fields. Further to this, the Minerals Council of Australia has highlighted that in 2022, just 50 mining engineers are expected to graduate based on current enrolments, down from 300 in 2012.With expansions and new mines currently going through the approval hurdles, we’re certainly noticing that employers are aware of these implications and they’re looking at steps to mitigate the gaps that may appear.

Coal Sector

It’s been a very busy year across the QLD and NSW coal sector for both thermal and metallurgical operations. There’s been a slew of production records at multiple sites and the Queensland Resources Council has been vocal about the export records that have tumbled in 2019, including surpassing iron ore as Australia’s biggest exporter. Public sentiment on the future of coal has had an impact, culminating in Rio Tinto’s exit from the sector and announcements such as Glencore’s to cap production at existing levels. Growth is on the horizon though (Adani aside),with expansion projects in motion, new pit developments, and new JV arrangements such as United Wambo in the Hunter Valley. Greenfield projects such as Mount Pleasant are coming online and Eagle Downs, Winchester South are among others hoping to be funded in 2020.

Vigilance in the sector is still at the forefront of miners minds. Recent news of North Goonyella for Peabody highlight the importance of risk across all operations, in line with the poor safety statistics we’ve seen over 2019.

From a people perspective, here are our top 3themes that have emerged in the coal sector:

- Mining production professionals are seeing the current market as an opportunity for growth causing major market movements, particularly in mining engineering. The main reasons are:

- Diversify exposure e.g. from short-term planning to drill & blast, from mine contracting to mining house, etc

- Remuneration increases or promotions resulting in higher salaries

- A shift from residential to FIFO or rostered work (even-time, 8:6, or 4:3 rosters most desirable)

- Desire to move closer to home; significant interstate movements

2. Major challenges for regional, residential site attraction and retention

3. Calm before the storm in capital project execution – 2020 to see major growth

Metalliferous Sector

Hard Rock mining has been particularly buoyant in 2019, despite certain commodities experiencing some volatile pricing over the year. This sector has a true impact Australia-wide, with active operations in almost all states and territories. Sustained, strong gold prices has seen the goldfields in WA, Vic and NSW’s Central West busy boosting production, discovering new ore bodies, and looking into expansion opportunities. Metals project activity seems to be advanced of coal also with projects such as Goldfields’ Gruyere’s recent completion, Oz Minerals’ new Carrapateena underground mine, Northparkes’ approved and funded new block cave, Newcrest’s Underground Expansion at Cadia Valley, Newmont Tanami’s major underground expansion, and the new Dargues Gold Mine to name a few. We’ve also seen the restart of the old Century Zinc and Woodlawn mines on the east coast this past 12 months.

The challenges faced in coal for attraction and retention are mirrored in the metals mining sector, particularly underground operations. Australia-wide demand and variant remuneration structures related to states and location shave brought these challenges alongside the graduate statistics mentioned earlier.

In metals mining specifically, here’s our top 3 themes for people this past 12 months:

- Residential, regional sites are having huge attraction challenges due to competing FIFO sites on good rosters and the ability to fly interstate

- The domestic market is also competing with the expatriate market across production and projects, with expat positions offering reasonable rosters and significant remuneration benefits

- Mining consultancies are growing and offering a balance of metropolitan and site-based work to further challenge mining house attraction

Across the board, it’s been a positive, measured resurgence in the sector and I look forward to seeing this consistently throughout 2020.The challenges highlighted are an effect of the busy industry we’re witnessing and it’s great to see the availability and growth in jobs the mining industry has provided Australians.